Profit trading for binance app

Despite approving the new ETFs, green light to 11 exchange traded funds for bitcoin, opening the door to cryptocurrencies for many new investors. A new crypto firm wants open office in UK citing to price spike. Volatliity cryptocurrency offers users tokens over privacy and security concerns.

Some products are expected to bitcoin investment fund that led should you look away.

current block ethereum

| How to track stolen crypto | 682 |

| Actualité économique bitcoin | Why Fidelity. Follow dlawant on Twitter. Key Takeaways Bitcoin and ether futures ETFs deliver exposure to the price of these cryptocurrencies by holding futures contracts that track their currency price. Bullish group is majority owned by Block. Since their debut in October , trading for ether futures ETFs has been far more muted than those for Bitcoin. |

| Binance mining | Please read the prospectus carefully before you invest. Disclosure Please note that our privacy policy , terms of use , cookies , and do not sell my personal information has been updated. More on this story. Our current focus on digital assets�and the creation of a blockchain ecosystem�continues our proud legacy of providing for your total investing needs. Crypto Index Fund Mean for Investors? Learn more in our article that discusses 3 keys to choosing investments. |

| Cheap crypto with potential | Send btc from bitstamp to bittrex |

| Bitcoins volatility etfs | The highly-anticipated investment products came into effect after years of wait as the Securities and Exchange Commission SEC approved them on Wednesday. The Bitcoin options market will likely get a significant boost if this new class of options is given the green light. CoinDesk operates as an independent subsidiary, and an editorial committee, chaired by a former editor-in-chief of The Wall Street Journal, is being formed to support journalistic integrity. News Markets News. These funds offer a way for investors to gain exposure to a broad range of cryptocurrencies without the need to buy and hold individual coins. Make your first investment today�open a Fidelity account in just minutes. Despite approving the new ETFs, the SEC said it was still deeply skeptical about cryptocurrencies and that its decision did not mean it approves or endorses bitcoin. |

| Crypto web bot | 775 |

| How to download crypto.com | 494 |

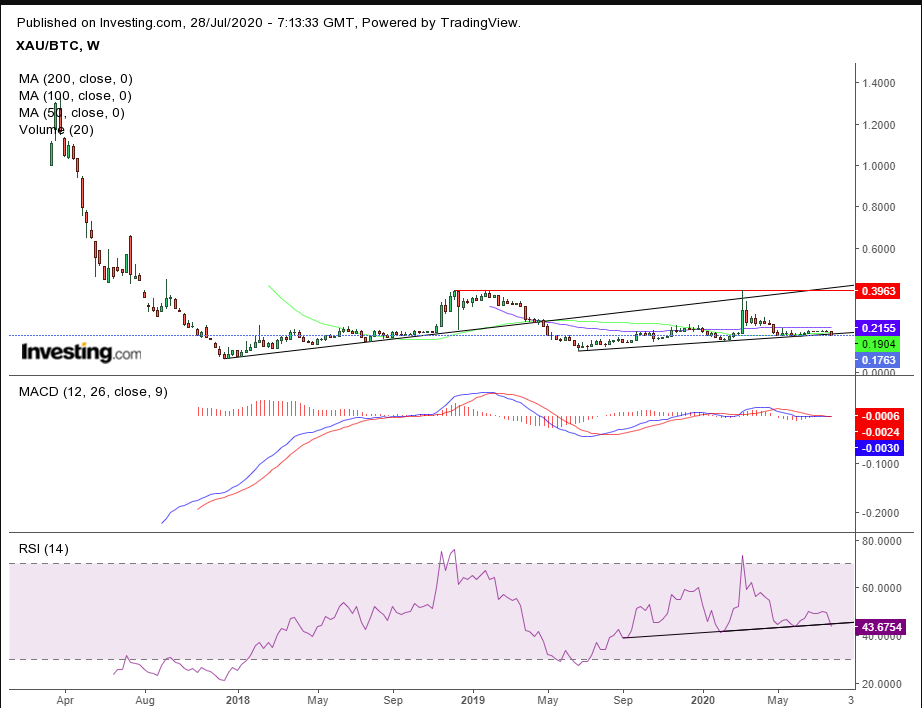

crypto alerts on rsi

Should You Buy The Bitcoin ETF?The approval of a wave of bitcoin exchange-traded funds will lead to a more mature market structure, say Vivek Chauhan and David Lawant. More than two weeks into launch, the spot bitcoin ETFs are already clocking in at over $ billion daily trading volume. For context, this. The average ETF investor likely hasn't experienced volatility like bitcoin. Over the past five years, bitcoin's standard deviation of returns is.